C10235v4 Bachelor of Accounting

Award(s): Bachelor of Accounting (BAcc)UAC code: 601010 (session 1)

Commonwealth supported place?: Yes

Load credit points: 150

Course EFTSL: 3.125

Location: City campus

Notes

This course is only offered to local students.

This is a scholarship degree intended for recent school leavers.

This course is not offered to international students.

Overview

Course aims

Career options

Innovation and Transdisciplinary program

Course intended learning outcomes

Admission requirements

Assumed knowledge

Course duration and attendance

Course structure

Course completion requirements

Course diagram

Course program

Levels of award

Honours

Professional recognition

Other information

Overview

The Bachelor of Accounting is a cooperative education program in accounting. It is an intensive course offered in conjunction with major employers. Students complete a compulsory first major in accounting and receive a scholarship and full-time work training.

This course is a specialist degree for high-achieving students who view an accounting career as an excellent foundation for future business leaders. All students in the course receive a scholarship of up to $54,000 over three years and a year of full-time industry experience and are encouraged to complete a second major or sub-major in another business discipline. Historically the course has a graduate employment rate greater than 95 per cent.

Course aims

The course aims to provide students with in-depth accounting knowledge with industry training by leading global organisations to become one of Australia's most employable graduates and future business leaders.

Career options

Career options include accountant, auditor, business analyst, investment manager, management accountant, taxation adviser. Experienced accountants are highly sought after in all industries as well as government and not-for-profit organisations.

Innovation and Transdisciplinary program

Transdisciplinarity and Innovation at UTSAll UTS students have the opportunity to develop distinctive capabilities around transdisciplinary thinking and innovation through the TD School. Transdisciplinary education at UTS brings together great minds from different disciplines to explore ideas that improve the way we live and work in the world. These offerings are unique to UTS and directly translate to many existing and emerging roles and careers.

Diploma in InnovationThe Diploma in Innovation (C20060) teaches innovation, supports personal transformation and provides the hard skills needed to support the inventors and inventions of the future. Students come out of the Diploma in Innovation, with the hard skills to create and support sectoral and societal transformation. Graduates are able to fluently integrate ideas, across professional disciplines and are inventors of the future.

All UTS undergraduate students (with the exception of students concurrently enrolled in the Bachelor of Creative Intelligence and Innovation) can apply for the Diploma in Innovation upon admission in their chosen undergraduate degree. It is a complete degree program that runs in parallel to any undergraduate degree. The course is offered on a three-year, part-time basis, with subjects running in 3-week long intensive blocks in July, December and February sessions. More information including a link to apply is available at https://dipinn.uts.edu.au.

Transdisciplinary electives programTransdisciplinary electives broaden students' horizons and supercharge their problem-solving skills, helping them to learn outside, beyond and across their degrees. Students enrolled in an undergraduate course that includes electives can choose to take a transdisciplinary subject (with the exception of students concurrently enrolled in the Bachelor of Creative Intelligence and Innovation). More information about the TD Electives program is available here.

Course intended learning outcomes

| 1.1 | Apply evidence, creativity and critical reasoning to solve business problems |

| 2.1 | Communicate information clearly in a form appropriate for its audience |

| 2.2 | Demonstrate ability to work independently and with others as a member of a team to achieve an agreed goal |

| 3.1 | Make judgements and business decisions consistent with the principles of social responsibility, inclusion and knowledge of Indigenous peoples |

| 4.1 | Apply technical and professional skills to operate effectively in business |

| 4.2 | Demonstrate the application of management fundamentals to lead with integrity in professional contexts |

Admission requirements

Applicants must have completed an Australian Year 12 qualification, Australian Qualifications Framework Diploma, or equivalent Australian or overseas qualification at the required level.

This is an intensive scholarship course for current school leavers. Special application and selection procedures apply, including an early closing date for applications.

The English proficiency requirement for local applicants with international qualifications is: Academic IELTS: 6.5 overall with a writing score of 6.0; or TOEFL: paper based: 550-583 overall with TWE of 4.5, internet based: 79-93 overall with a writing score of 21; or AE5: Pass; or PTE: 58-64 with a writing score of 50; or C1A/C2P: 176-184 with a writing score of 169.

Eligibility for admission does not guarantee offer of a place.

Assumed knowledge

Mathematics and any two units of English.

UTS offers a range of bridging courses for students who do not meet the assumed knowledge requirements.

Course duration and attendance

The course is completed in three years of full-time study, which includes two separate half years of full-time work training. Some subjects are fast-tracked over Summer session (only in the first session), while others are taken part-time during full-time work training, to allow completion of the degree within three years.

Course structure

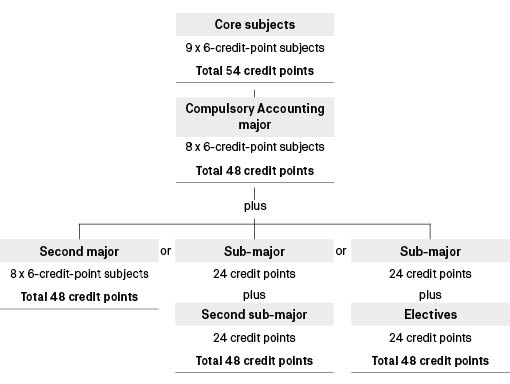

The course comprises a total of 150 credit points. The study components for course completion are:

- 54 credit points of core subjects and either:

- Accounting major (48 credit points)

- 48 credit points comprising of either:

- a second major (48 credit points), or

- two sub-majors (24 credit points each), or

- a sub-major (24 credit points) in conjunction with elective subjects (24 credit points)

Students can choose any one of the following as a second major: Business Data Analytics, Economics, Finance, Human Resource Management, International Business, Management, Marketing, Advertising and Marketing Communications, Business Law or Information Technology.

Electives (totalling 24 credit points) can be taken from any faculty in the university, with the approval of the owning Faculty. For more information on business electives, please see the Business Electives page.

Industrial training/professional practice

This course includes two full-time, six-month industry internships, with two different sponsoring employers.

The first internship is in the second half of the first year of the course; the second internship is in the first half of the third year of the course. Students are not paid by the sponsoring employer during these internships but continue to receive their scholarship.

Course completion requirements

| CBK90186 Major/Two sub-majors/Sub-major + four electives | 48cp | |

| MAJ08437 Accounting | 48cp | |

| STM90285 Core subjects (Accounting) | 54cp | |

| Total | 150cp |

Course diagram

Course program

Typical full-time and part-time programs for Autumn commencements are provided below. Course programs for each second major are available on the Manage your course page.

| Session 1 commencing | ||

| Year 1 | ||

| Session 1 | ||

| 22108 Accounting and Accountability | 6cp | |

| 22605 Accounting Information Systems | 6cp | |

| Autumn session | ||

| 22208 Accounting, Business and Society | 6cp | |

| 25300 Fundamentals of Business Finance | 6cp | |

| 23115 Economics for Business | 6cp | |

| 21214 Business and Social Impact | 6cp | |

| 26134 Business Statistics | 6cp | |

| Spring session | ||

| 22157 Australian Corporate Environment | 6cp | |

| 24109 Marketing and Customer Value | 6cp | |

| Year 2 | ||

| Session 1 | ||

| 22321 Cost Management Systems | 6cp | |

| Autumn session | ||

| 22320 Accounting for Business Combinations | 6cp | |

| 79017 Taxation Law | 6cp | |

| Select 12 credit points of options | 12cp | |

| Spring session | ||

| 79014 Applied Company Law | 6cp | |

| 22421 Information for Decisions and Control | 6cp | |

| 22420 Accounting Standards and Regulations | 6cp | |

| Select 12 credit points of options | 12cp | |

| Year 3 | ||

| Autumn session | ||

| 22522 Assurance Services and Audit | 6cp | |

| 22319 Business Analysis (Capstone) | 6cp | |

| Spring session | ||

| Select 24 credit points of options | 24cp | |

Levels of award

The Bachelor of Accounting may be awarded with distinction, credit or pass.

Honours

The Bachelor of Business (Honours) (C09004) is available with an additional one year of full-time study for eligible students.

Professional recognition

To meet the educational membership requirements (pending confirmation of renewal) for entry into CPA Australia (CPAA), Chartered Accountants of Australia and New Zealand (CAANZ), Chartered Institute of Management Accountants (CIMA), Association of Chartered Certified Accountants (ACCA), and Institute of Public Accountants (IPA) students will need to complete the Accounting major and successfully complete subject 21644 Law and Ethics for Managers as either an elective or part of another major (applicable to students commencing from 2022 only).

Other information

Further information is available at Bachelor of Accounting, or contact:

Office of Cooperative Education

Accounting Discipline Group

Email: carin.alberts@uts.edu.au